The expectations augmented Phillips curve postulates

△p = π - f (u -  ),

),

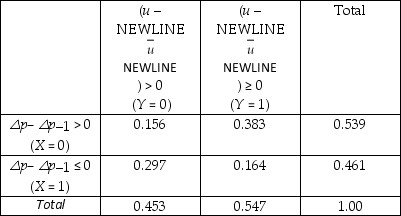

where △p is the actual inflation rate,π is the expected inflation rate,and u is the unemployment rate,with "-" indicating equilibrium (the NAIRU - Non-Accelerating Inflation Rate of Unemployment).Under the assumption of static expectations (π = △p-1),i.e. ,that you expect this period's inflation rate to hold for the next period ("the sun shines today,it will shine tomorrow"),then the prediction is that inflation will accelerate if the unemployment rate is below its equilibrium level.The accompanying table below displays information on accelerating annual inflation and unemployment rate differences from the equilibrium rate (cyclical unemployment),where the latter is approximated by a five-year moving average.You think of this data as a population which you want to describe,rather than a sample from which you want to infer behavior of a larger population.The data is collected from United States quarterly data for the period 1964:1 to 1995:4.

Joint Distribution of Accelerating Inflation and Cyclical Unemployment,

1964:1-1995:4

(a)Compute E(Y)and E(X),and interpret both numbers.

(a)Compute E(Y)and E(X),and interpret both numbers.

(b)Calculate E(Y  = 1)and E(Y

= 1)and E(Y  = 0).If there was independence between cyclical unemployment and acceleration in the inflation rate,what would you expect the relationship between the two expected values to be? Given that the two means are different,is this sufficient to assume that the two variables are independent?

= 0).If there was independence between cyclical unemployment and acceleration in the inflation rate,what would you expect the relationship between the two expected values to be? Given that the two means are different,is this sufficient to assume that the two variables are independent?

(c)What is the probability of inflation to increase if there is positive cyclical unemployment? Negative cyclical unemployment?

(d)You randomly select one of the 59 quarters when there was positive cyclical unemployment ((u -  )> 0).What is the probability there was decelerating inflation during that quarter?

)> 0).What is the probability there was decelerating inflation during that quarter?

Definitions:

Debts Barred

Relates to debts that cannot be legally recovered due to the expiration of a statute of limitations.

Statutes Of Limitations

Laws that set the maximum time after an event within which legal proceedings may be initiated, thus limiting the duration a party can be sued or charged.

Inadequate Consideration

This term implies an agreement in which the value exchanged between two parties is significantly disproportionate, questioning the fairness of the deal.

Promissory Estoppel

A legal principle that prevents a promisor from denying the promise or going back on it if the promisee has reasonably relied on the promise to their detriment.

Q9: The neoclassical growth model predicts that for

Q13: To provide quantitative answers to policy questions<br>A)it

Q19: To investigate whether or not there is

Q21: Storing an asset entails risk.

Q24: The extended least squares assumptions in the

Q26: The news-magazine The Economist regularly publishes data

Q36: Imagine you regressed earnings of individuals on

Q42: In order to make reliable forecasts with

Q48: Your textbooks gives several examples of quasi

Q59: SAT scores in Mathematics are normally distributed