The neoclassical growth model predicts that for identical savings rates and population growth rates,countries should converge to the per capita income level.This is referred to as the convergence hypothesis.One way to test for the presence of convergence is to compare the growth rates over time to the initial starting level,i.e. ,to run the regression  =

=  +

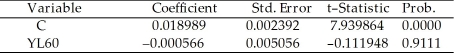

+  × RelProd60 ,where g6090 is the average annual growth rate of GDP per worker for the 1960-1990 sample period,and RelProd60 is GDP per worker relative to the United States in 1960.Under the null hypothesis of no convergence,β1 = 0;H1 : β1 < 0,implying ("beta")convergence.Using a standard regression package,you get the following output:

× RelProd60 ,where g6090 is the average annual growth rate of GDP per worker for the 1960-1990 sample period,and RelProd60 is GDP per worker relative to the United States in 1960.Under the null hypothesis of no convergence,β1 = 0;H1 : β1 < 0,implying ("beta")convergence.Using a standard regression package,you get the following output:

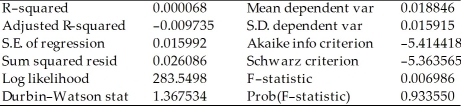

Dependent Variable: G6090

Method: Least Squares

Date: 07/11/06 Time: 05:46

Sample: 1 104

Included observations: 104

White Heteroskedasticity-Consistent Standard Errors & Covariance

You are delighted to see that this program has already calculated p-values for you.However,a peer of yours points out that the correct p-value should be 0.4562.Who is right?

You are delighted to see that this program has already calculated p-values for you.However,a peer of yours points out that the correct p-value should be 0.4562.Who is right?

Definitions:

Stock Index Futures

Futures contracts where the underlying asset is a stock market index, used for speculation or hedging against market movements.

Multiplier

In economics and finance, a factor that quantifies the impact of an increase in spending or investment on the overall income or output of an economy, often used to measure the effects of fiscal policy.

Dollars

The official currency of the United States, used as a standard monetary unit.

Annual Risk-free Rate

The theoretical rate of return of an investment with zero risk over a one-year period, often represented by government bonds.

Q5: Experimental effects,such as the Hawthorne effect,<br>A)generally are

Q12: The dynamic OLS (DOLS)estimator of the cointegrating

Q12: The reliability of a study using multiple

Q19: Cash markets are also known as<br>A)speculative markets<br>B)spot

Q25: Economic theory suggests that the law of

Q33: (Advanced)Unbiasedness and small variance are desirable properties

Q38: The WLS estimator is called infeasible WLS

Q39: You have estimated the relationship between testscores

Q43: What is the probability of the following

Q45: Small sample sizes in an experiment<br>A)biases the