(Requires Appendix material)Your textbook states that in "the distributed lag regression model,the error term ut can be correlated with its lagged values.This autocorrelation arises,because,in time series data,the omitted factors that comprise ut can themselves be serially correlated."

(a)Give an example what the authors have in mind.

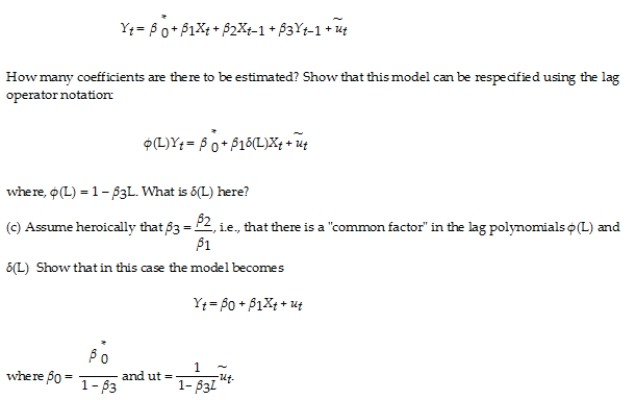

(b)Consider the ADL model,where the X's are strictly exogenous,and there is no autocorrelation (and/or heteroskedasticity)in the error term.  (d)Explain why autocorrelation in this model can be seen as a "simplification," not a "nuisance." Can you use the F-test to test the above hypothesis? Why or why not?

(d)Explain why autocorrelation in this model can be seen as a "simplification," not a "nuisance." Can you use the F-test to test the above hypothesis? Why or why not?

Definitions:

Overstatement

An error or inaccuracy in accounting records or financial statements where the value of assets, revenues, or profit is recorded higher than the actual amounts.

Net Realizable Value

The estimated selling price of goods minus the cost of their sale or disposal, used in determining the value of inventory on the balance sheet and for assessing asset impairment.

Write-Down

An accounting practice of reducing the book value of an asset because it's overvalued compared to the market value.

Financial Statements

Compiled reports detailing the financial position, performance, and cash flows of a business over a specific period.

Q5: Suppose relative risk between <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5065/.jpg" alt="Suppose

Q9: (Requires Calculus)For the simple linear regression model

Q13: The population logit model of the binary

Q32: The class of linear conditionally unbiased estimators

Q34: An insurance company has conducted a study

Q36: Show in a scatterplot what the relationship

Q36: (Requires Internet Access for the test question)<br>The

Q41: You have a limited dependent variable (Y)and

Q47: One of the following is a regression

Q59: You have obtained measurements of height in