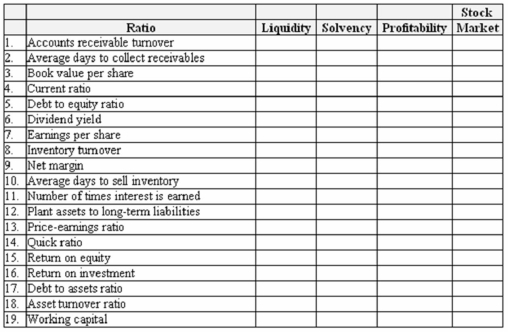

Various ratios are computed to assess different aspects of a company's financial condition and/or strength.

Required:

In the table below, indicate which aspect of financial condition each specified ratio is designed to assess:

Definitions:

Shared Leadership Climate

An organizational atmosphere where leadership responsibilities are distributed among team members rather than centralized in a single leader.

Marginal Tax Rate

The rate at which an additional dollar of taxable income would be taxed.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), representing the average taxation faced by an individual or firm.

Taxable Income

The amount of income that is subject to income tax after deductions and exemptions.

Q2: Suppose we calculate the percent change in

Q37: Preferred stockholders generally have no voting rights

Q42: Charleston Corporation made the following entry it

Q64: In the year 2014 the five richest

Q66: In September of 2013, Houston Company issued

Q85: Real GDP is the _ of all

Q90: Garza, Inc. and Marx, Inc. each had

Q97: When a corporation records a stock dividend,

Q110: Maryland Company's balance sheet and income statement

Q120: FICA taxes are both recorded as salary