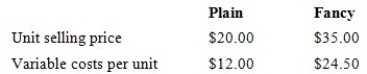

Maxie Pty Ltd makes and sells two types of shoes, Plain and Fancy. Product data is as follows:

Sixty per cent of the sales in units are Plain and annual fixed expenses are $45 000 and the sales mix remains constant. Assume an income tax rate of 20 per cent.

The break-even point for this data is 5000 units in total. How will the calculation of the break-even point change (if at all) if the relative percentages of the products in the mix change from 60 per cent Plain shoes to 40 per cent Fancy shoes?

Definitions:

Profitability Index

A financial tool that calculates the ratio of the present value of future expected cash flows to the initial investment cost.

Working Capital

A disparity between a firm's current holdings and its outstanding obligations, signifying its short-term economic fitness and effectiveness in functioning.

Discount Rate

In the context of discounted cash flow analysis, this is the interest rate used to establish the present-day value of future cash inflows.

Net Operating Cash Inflows

This represents the cash that a business generates from its ordinary, operational activities, excluding financing or investment cash flows.

Q2: Which of the following is not a

Q10: Strategic alliances are informal arrangements between two

Q11: Which of the following statements regarding absorption

Q17: The total cost curve:<br>A) shows the changes

Q36: On which of the following is the

Q61: According to Perrow's contingency model of organizational

Q67: Calculate the asset turnover from the following

Q72: A customer has placed an order with

Q75: Characteristics for information for decision making<br>i. One

Q88: Managers must have an understanding of customers'