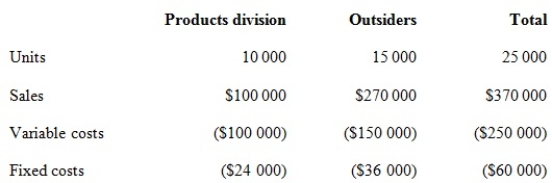

Corporate policy at Weber Pty Ltd requires that all transfers between divisions be recorded at variable cost as a transfer price. Divisional managers have complete autonomy in choosing their sources of customers and suppliers. The Milling Division sells a product called RK2. Forty per cent of the sales of RK2 are to the Products Division, while the remainder of the sales are to outside customers. The manager of the Milling Division is evaluating a special offer from an outside customer for 10 000 units of RK2 at a per unit price of $15. If the special offer were accepted, the Milling Division would be unable to supply those units to the Products Division. The Products Division could purchase those units from another supplier for $17 per unit. Annual capacity for the Milling Division is 25 000 units. The 2014 budget information for the Milling Division, based on full capacity, is presented below.

Assume the company permits the division managers to negotiate a transfer price. The managers agree to a $15 transfer price adjusted to share equally the additional gross margin to Milling Division resulting from the sale to the Products Division. What is the agreed transfer price?

Definitions:

Achievement Tests

Standardized tests designed to measure an individual's level of skill, accomplishment, or knowledge in a specific area.

Locus of Control

The degree to which individuals believe that they have control over the outcome of events in their lives, as opposed to external forces having that control.

Generalized Expectancies

A psychological concept referring to an individual's belief or expectation that their behavior can lead to certain outcomes, regardless of the specific situation.

Locus of Control

An individual’s belief about the extent to which their actions influence the outcomes or events in their lives.

Q3: Calculate the cost of processing one sales

Q13: Which of the following is not a

Q37: An example of a conventional environmental cost

Q64: For which of the following reasons are

Q66: A standard cost is<br>A) the actual cost

Q71: When determining the total costs of purchasing,

Q71: Management requiring guidance on how to identify

Q77: For a particular period a firm worked

Q85: Which of the following statements is/are true

Q90: A favourable labour rate variance leads to