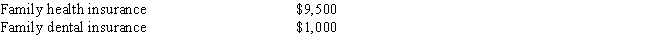

Mike and Rose are married. Mike earns $45,000 from wages and Rose reports $350 on her Schedule C as an artist. Since Mike's work does not offer health insurance, Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Definitions:

Stockholder Claims

The rights or interests that shareholders have in a company, primarily related to dividends and assets in the event of liquidation.

Bondholders

Individuals or institutions that own bonds issued by corporations or governments, entitling them to receive the bond's principal back plus interest payments.

Interest and Repayment

Terms referring to the cost of borrowing money (interest) and the act of paying back borrowed funds (repayment).

Callable Bonds

Bonds that can be redeemed by the issuer before their maturity date at a predetermined price.

Q31: XYZ Corporation has assigned Allison to inspect

Q32: Inheritances

Q37: In 2014, all taxpayers may make a

Q41: In the Boston Consulting Group (BCG) matrix,

Q41: BOND Corporation is owned 25 percent by

Q43: To be depreciated, must an asset actually

Q57: Child support payments

Q58: In the BCG matrix, a _ has

Q85: Calculate the following amounts:<br>a. The first year

Q114: Katie operates a ceramics studio from her