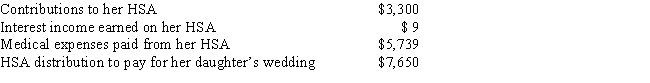

Miki, who is single and 57 years old, has a quaifying high-deductible insurance plan. She had the following transactions with her HSA during the year:

a. How much may Miki claim as a deduction for adjusted gross income?

b. What is the amount that Miki must report on her tax return as income from her HSA?

c. How much is subject to a penalty? What is the penalty percentage?

Definitions:

Budgeting Process

A systematic approach to estimating the financial performance and resource requirements of a business for a future period, typically involving setting goals and preparing detailed plans.

Management Levels

The multiple layers of management in an organization, typically ranging from top-level executives to mid-level and then first-level managers.

Budget Standards

These are predetermined costs or revenues that serve as benchmarks for evaluating the performance of different departments within an organization.

Employees' Involvement

Refers to the extent to which employees can contribute to decision-making processes within a company, impacting its operations and policies.

Q7: Barry is age 45 and a single

Q20: Emily's Bakery's customers have asked her to

Q24: Moe has a law practice and earns

Q44: Computer peripherals provider Ascent plans to enter

Q53: Mike and Rose are married. Mike earns

Q60: Jenny adopts a Vietnamese orphan. The adoption

Q65: Sol purchased land as an investment on

Q77: Denice is divorced and files a single

Q80: Which of the following strategies involves a

Q97: There is a limitation of $25 per