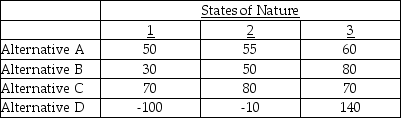

A decision maker using the maximin criterion on the problem below would choose Alternative ________ because the maximum of the row minimums is ________.

Definitions:

Total Tax Rate

The comprehensive rate at which income is taxed, combining the effects of both federal and state rates, and possibly other levies.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, showcasing how much tax will be paid on an additional dollar of income.

Taxable Income

The amount of an individual's or corporation's income used to determine how much tax is owed to the federal government.

Q3: Service blueprinting:<br>A)provides the basis to negotiate prices

Q8: Two methods of solving linear programming problems

Q23: Which of the following represents a customer

Q52: Which of the following is NOT one

Q52: Learning curves (or experience curves)were first applied

Q71: What is the expected value with perfect

Q79: A(n)_ is a special product-oriented arrangement of

Q97: Which of the following statements regarding "proximity"

Q99: The techniques for addressing the fixed-position layout

Q113: A(n)_ queuing system has one waiting line,but