LINDO output is given for the following linear programming problem.

MIN 12 X1 + 10 X2 + 9 X3

SUBJECT TO

END

LP OPTIMUM FOUND AT STEP 1

OBJECTIVE FUNCTION VALUE

1)80.000000

2)

3) NO.ITERATIONS= 1

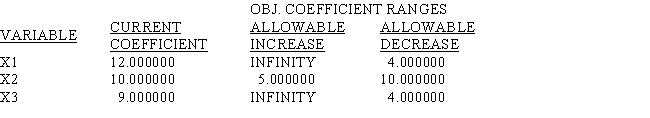

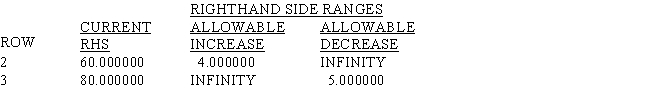

RANGES IN WHICH THE BASIS IS UNCHANGED:

a.What is the solution to the problem?

b.Which constraints are binding?

c.Interpret the reduced cost for x1.

d.Interpret the dual price for constraint 2.

e.What would happen if the cost of x1 dropped to 10 and the cost of x2 increased to 12?

Definitions:

Interest Rate

The percentage of a sum of money charged for its use, typically expressed as an annual percentage rate.

Undergraduate Students

Individuals enrolled in a college or university program leading to a bachelor's degree or similar qualification.

Private Student Loan

A non-federal lending option for education, provided by banks or financial institutions, that is not backed by the government.

Bank

A financial institution authorized to receive deposits, offer loans, and provide various financial services to its customers.

Q18: To find the choice that provides the

Q19: The product design and market share optimization

Q22: If the acceptance of project A is

Q23: According to evolutionary scientists,a theory of mind

Q24: Blending problems arise whenever a manager must

Q25: A random variable that has a normal

Q28: The standard normal distribution is a normal

Q32: PERT and CPM<br>A)are most valuable when a

Q40: Super Cola is considering the introduction

Q44: The use of integer variables creates additional