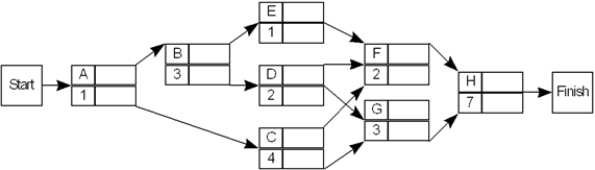

Consider the following PERT/CPM network with estimated times in weeks.The project is scheduled to begin on May 1.

The three-time estimate approach was used to calculate the expected times and the following table gives the variance for each activity:

a.Give the expected project completion date and the critical path.

b.By what date are you 99% sure the project will be completed?

Definitions:

Merchandise Sold

The products that a retailer, wholesaler, or distributor has sold to customers during a specific period.

Gross Profit

The income left over for a company once it has covered the costs involved in manufacturing and selling its products, or in offering its services.

Merchandise Sold

Products or goods that have been sold to customers, typically referring to transactions within the retail or wholesale sector.

Cost of Goods Sold

Directly incurred costs associated with the production of a company’s goods for sale, comprising material and labor expenses.

Q1: LINDO output is given for the

Q8: Activities require time to complete while events

Q8: The number of units shipped from origin

Q10: For the multiperiod production scheduling problem in

Q22: For a situation with weekly dining at

Q25: The average collection period shows the approximate

Q47: Nonlinear programming algorithms are more complex than

Q67: Under the allowance method,when a company writes

Q77: We calculate the times interest earned ratio

Q165: Shupe Inc.estimates uncollectible accounts based on the