Walterboro, Inc., has done a cost analysis for its production of decals. The following activities and cost drivers have been developed: Activity Cost Formula

Maintenance $11,000 + $0.11 per machine hour

Machining $25,000 + $0.50 per machine hour

Setups $50 per batch

Purchasing $200 + $45 per purchase order

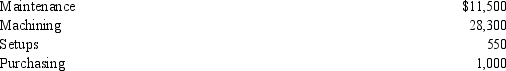

Following are the actual costs of producing 85,000 decals: 5,000 machine hours; 10 batches; 20 purchase orders What is the budget variance for setups in an activity-based performance report?

What is the budget variance for setups in an activity-based performance report?

Definitions:

Controlling Interest

Holding a majority of the voting stock or interest in a company, thereby having significant influence or control over its operations and decision-making.

Net Incomes

The total earnings of a company after deducting all expenses, taxes, and costs from its total revenues.

Deferred Income Tax

Deferred Income Tax is a liability on a company's balance sheet that results from income already earned and recognized for accounting purposes but not yet subject to taxation.

Q11: Laramie, Inc., has an operating environment with

Q24: Refer to Figure 7-2. Using both a

Q32: JIT manufacturing eliminates waste by producing products

Q57: The right to buy a certain number

Q59: Refer to Figure 9-4. What is the

Q74: Explain the difference between acceptable quality level

Q75: The following information pertains to the three

Q86: The period of time when sales increase

Q116: Operating expense budgets include the marketing expense

Q138: Victory, Inc., manufactures a product that passes