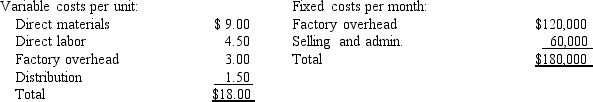

Hobart Company produces speakers for home stereo units. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales

The variable distribution costs are for transportation to the retail music stores. The current production and sales

Volume is 20,000 per year. Capacity is 25,000 units per year.

A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $17.00 per unit. If Hobart Company accepts the offer, it will be able to rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

Definitions:

Equity-Financed

Financing obtained through the sale of company shares, contributing to the capital structure without incurring debt.

Combined Firm

describes a business entity that results from the merger or acquisition of two or more firms, combining assets, liabilities, and operations.

Incremental Value

It is the additional value generated by an investment, project, or action over the current baseline or alternative options.

All-Equity Firms

Companies that finance their operations exclusively through equity without any debt.

Q2: Technical efficiency is concerned with a given

Q19: Listed below are several possible combinations for

Q24: Inventory values calculated using variable costing as

Q30: Decisions consisting of selecting among alternatives with

Q74: A successful firm<br>A) places appropriate emphasis on

Q101: At a price of $48, the estimated

Q108: Lower sales due to poor product performance

Q116: The internal rate of return is defined

Q119: Biscuit Company sells its product for $50.

Q177: Which of the following statements is true