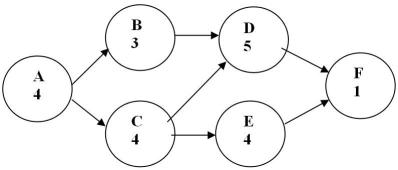

Figure to accompany Table 2.9  Table 2.9

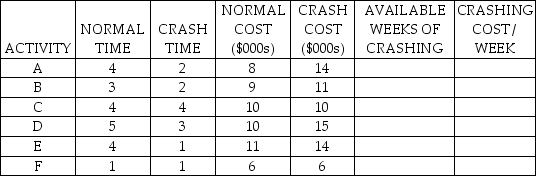

Table 2.9

-How many weeks of crashing are available for activity C in Table 2.9?

Definitions:

Systematic Risk

The risk inherent to the entire market or market segment, which cannot be eliminated through diversification.

Beta

Beta is a measure of the volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole, indicating its sensitivity to market movements.

Market Index

A hypothetical portfolio of investment holdings that represents a segment of the financial market, used as a benchmark to measure an investment's performance.

Standard Deviation

A statistical measurement of variation or dispersion around an average, indicating how much a set of numbers is spread out.

Q30: What are any three dimensions of quality

Q57: _ is the documentation and detailed understanding

Q60: Work sampling can be used to estimate

Q71: The project manager and team can step

Q92: A project has three paths.A-B-C has a

Q95: A payoff table shows the amount for

Q110: Benchmarking is a continuous,systematic procedure that measures

Q130: A manufacturer embarking on a Six Sigma

Q140: Activity times for a project are estimated

Q142: Which one of the following techniques will