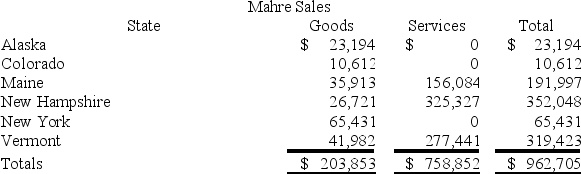

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store which ships to out-of-state customers. The ski tours operate in Maine, New Hampshire, and Vermont where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit in Maine?

Definitions:

Tax Liability

The total amount of tax owed to federal, state, or local tax authorities for a given period.

Form 4070

A tax form used by employees in the United States to report tips received to their employer.

Tax Withholding

The portion of an employee's wages that is not included in their paycheck because it is sent directly to the federal, state, or local tax authorities as partial payment of income tax.

FICA Taxes

Taxes collected under the Federal Insurance Contributions Act to fund Social Security and Medicare, required deductions from workers' paychecks.

Q7: S corporations are not entitled to a

Q21: Which of the following is a true

Q39: Which of the following is NOT an

Q48: Property is included in the gross estate

Q60: Which person would generally be treated as

Q67: Jamie transferred 100 percent of her stock

Q100: Shea is a 100% owner of Mets

Q113: This year Carlos and Hailey purchased realty

Q114: When a gift-splitting election is made, gifts

Q125: During 2018, CDE Corporation (an S corporation