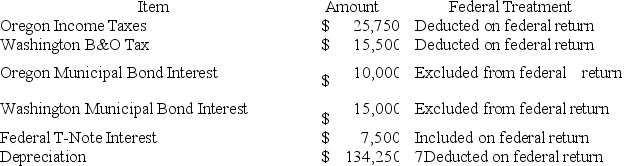

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Definitions:

Quality Of Writing

The degree to which written content achieves excellence in aspects such as clarity, coherence, accuracy, and engagement for its intended audience.

Under Developed Thesis

A thesis statement that lacks sufficient detail, depth, or specificity required to guide the structure and argument of an essay or research paper.

Interactive Combination

A process where elements interact or combine in ways that influence or affect each other, leading to a new or enhanced result.

Mode Of Communication

The method or means through which information or messages are conveyed from one entity to another, including verbal, non-verbal, written, and digital forms.

Q1: Kristen and Harrison are equal partners in

Q6: TQK, LLC provides consulting services and was

Q7: Locke is a 50% partner in the

Q28: Which of the following requirements do not

Q38: Tennis Pro, a Virginia Corporation domiciled in

Q53: Gordon operates the Tennis Pro Shop in

Q63: Kathy purchases a one-third interest in the

Q70: Inez transfers property with a tax basis

Q81: A withdrawal of money from a bank

Q85: Guaranteed payments are included in the calculation