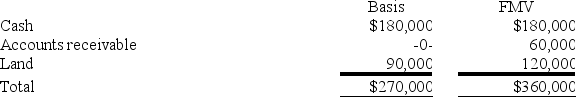

The SSC Partnership balance sheet includes the following assets on December 31 of the current year:  Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

Definitions:

Polysaccharide

Polysaccharides are long carbohydrate molecules made of monosaccharide units bonded together, serving as energy storage or structural components in living organisms.

Monosaccharides

Simple sugars that are the most basic form of carbohydrates, serving as the building blocks for more complex sugars and polysaccharides.

Fermentation

An anaerobic process by which ATP is produced by a series of redox reactions in which organic compounds serve both as electron donors and terminal electron acceptors.

NADH

Nicotinamide adenine dinucleotide (reduced form) is a coenzyme involved in redox reactions, carrying electrons from one reaction to another in cellular metabolism.

Q1: Bruin Company reports current E&P of $200,000

Q11: Which of the following statements regarding income

Q15: Which of the following would not result

Q39: All of the following are false regarding

Q44: RGD Corporation was a C corporation from

Q53: A partner's self-employment earnings (loss) may be

Q67: Christian transferred $60,000 to an irrevocable trust

Q68: Which of the following best describes the

Q109: Suppose at the beginning of 2018, Jamaal's

Q110: What was the Supreme Court's holding in