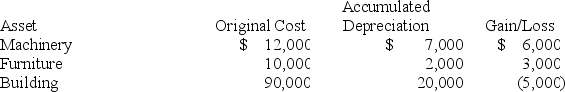

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Iliac Fossa

A concave surface on the inner side of the ilium, part of the pelvic bone, which serves as the origin for several muscles.

Medial Side

The side of a body part or structure that is closest to the midline of the body.

Ilium

The Ilium is the largest bone of the pelvis, constituting the uppermost and largest part of the hip bone.

Ischial Tuberosity

The part of the pelvis where the sitting bones are located and where some of the thigh muscles attach.

Q3: Lexa, a single taxpayer, worked as an

Q12: Which of the following statements regarding late

Q15: Which of the following business expense deductions

Q26: Cassandra, age 33, has made deductible contributions

Q49: Parents may claim a child and dependent

Q49: If an individual taxpayer's marginal tax rate

Q52: Francis works for a local fly fishing

Q69: Taffy Products uses the accrual method and

Q81: Which of the following is a true

Q119: During all of 2018, Mr. and Mrs.