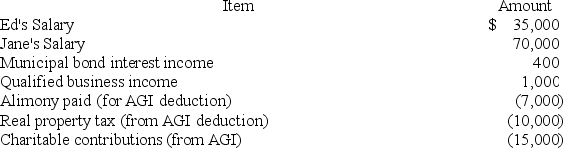

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What are the couple's taxes due or tax refund (use the tax rate schedules not tax tables)?

Definitions:

Optimal Pace

Optimal pace refers to the most efficient or effective speed at which an activity or process can proceed to achieve the best outcomes without compromising quality.

Sequencing

The arrangement of events, actions, or items in a particular order.

Buildup of Resistance

The gradual increase in opposition or pushback against a particular idea, change, or directive.

Sense of Continuity

The perception or belief in the ongoing, uninterrupted existence or operation of something.

Q7: The Crane family recognized the following types

Q30: Cassy reports a gross tax liability of

Q65: Bobby and Sissy got married 2.5 years

Q82: To determine filing status, a taxpayer's marital

Q89: If tax rates will be higher next

Q90: Nolene suspects that one of her new

Q92: This year Darcy made the following charitable

Q101: Which of the following committees typically initiates

Q110: If Susie earns $750,000 in taxable income,

Q114: The level to which water will rise