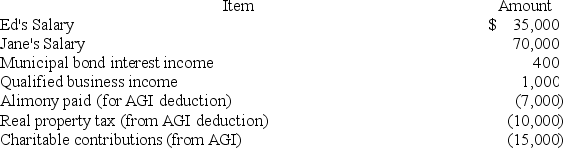

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's adjusted gross income?

Definitions:

Half-Life

The time required for half the atoms of a radioactive substance to decay or disintegrate, a measure of the stability of the substance.

Steady-State Concentration

The concentration of a substance in a system where its rate of input and rate of process removal are equal.

Medical Dosages

The prescribed amount of medication to be taken by a patient, usually measured in terms of quantity or concentration.

Dosage Interval

The time between doses of a medication, critical for maintaining the therapeutic level of the drug in the bloodstream.

Q20: Keith and Nicole are married filing joint

Q23: Simon was awarded a scholarship to attend

Q38: In 2018, Shawn's AGI is $170,000. He

Q44: Most of the surface of the Arctic

Q62: Namratha has the choice between investing in

Q75: Rachel is an accountant who practices as

Q94: Assume Georgianne underpaid her estimated tax liability

Q119: Which of the following is a true

Q120: Spring tides are defined as those which

Q122: A taxpayer may not qualify for the