Figure 11-A

Figure 11-A

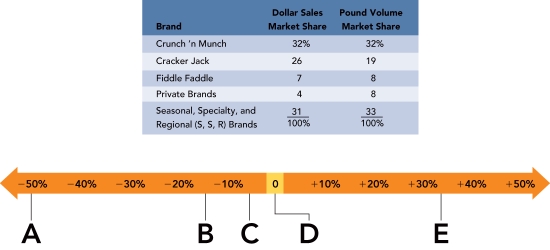

-Frito-Lay is considering whether to buy the Cracker Jack brand of caramel popcorn from Borden,Inc.Frito-Lay research shows that Cracker Jack has a strong brand equity.But,Cracker Jack's dollar sales market share and pound (a surrogate for unit) volume market share have declined recently and trailed the Crunch 'n Munch brand as shown in the Figure 11-A marketing dashboard above.Borden's management used an above-market,premium pricing strategy for Cracker Jack.As a Frito-Lay marketer studying Cracker Jack,calculate Cracker Jack's price premium.What position in Figure 11-A above represents the price premium of Cracker Jack?

Definitions:

Jury Duty Pay

Compensation received by a juror for performing jury service in a court, which is considered taxable income.

Deducted

Subtracted or taken away from a total amount, often in the context of calculating taxable income or expenses.

Stock Dividend

A dividend payment made by a company to its shareholders in the form of additional shares, rather than cash.

Taxable

Subject to taxation by governmental authorities.

Q29: When a company uses a product line

Q62: Which of the following is the first

Q85: Conflict occurring between intermediaries at the same

Q159: When Hallmark cards introduced a line of

Q184: Warranties,money-back guarantees,extensive usage instructions,demonstrations,and free samples are

Q204: The initial purchase of a product by

Q226: Walmart is a channel captain because of

Q291: A skimming pricing policy is likely to

Q306: The three basic functions intermediaries perform are<br>A)accommodating,logistical,and

Q379: Frito-Lay is considering whether to buy the