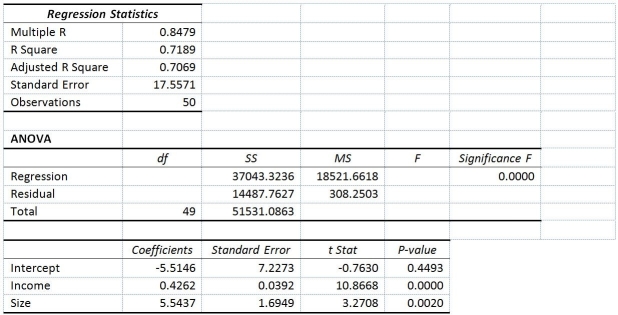

TABLE 14-4

A real estate builder wishes to determine how house size (House)is influenced by family income (Income)and family size (Size).House size is measured in hundreds of square feet and income is measured in thousands of dollars.The builder randomly selected 50 families and ran the multiple regression.Partial Microsoft Excel output is provided below:  Also SSR (X1 ∣ X2)= 36400.6326 and SSR (X2 ∣ X1)= 3297.7917

Also SSR (X1 ∣ X2)= 36400.6326 and SSR (X2 ∣ X1)= 3297.7917

-Referring to Table 14-4,the value of the partial F test statistic is ________ for

H0 : Variable X1 does not significantly improve the model after variable X2 has been included

H1 : Variable X1 significantly improves the model after variable X2 has been included

Definitions:

Total Variable Cost

The total expense that changes in proportion to changes in the volume of output or production.

AVC

Average Variable Cost, which is the total variable costs of production divided by the quantity of output produced.

ATC

Stands for Average Total Cost, a metric that represents the per-unit total cost of production, including both fixed and variable costs.

MR

Short for Marginal Revenue, the increase in total revenue a firm receives from selling one additional unit of a good or service.

Q27: Referring to Table 14-6,the value of the

Q28: True or False: Referring to Table 15-5,there

Q47: Referring to Table 17-12,what is the estimated

Q61: Referring to Table 17-9,_ of the variation

Q92: Referring to Table 17-9,what is the value

Q110: Referring to Table 16-3,if this series is

Q115: Referring to Table 13-10,generate the residual plot.

Q151: Referring to Table 14-8,the analyst wants to

Q153: True or False: Referring to Table 14-17,the

Q322: Referring to Table 14-7,the net regression coefficient