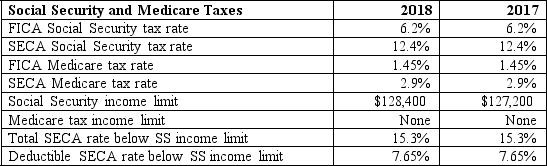

Jose worked at an architectural firm as an employee for the first four months of 2018 before he established his own business. He earned $53,300 at the architectural firm. His net income from his sole proprietorship was $78,000. Determine Jose's self-employment tax for 2018.

Definitions:

Q3: Carol wants to invest in a project

Q4: The actual data transfer rate is called

Q6: During the current year, Zach had taxable

Q17: _ is another name for data transfer

Q40: Moore Corporation (a calendar-year taxpayer), acquired a

Q56: Qualified deferred compensation plans have the following

Q62: Donald, a sole proprietor, worked in Chicago

Q82: Child support received

Q93: Sanjuro Corporation (a calendar-year corporation) purchased and

Q96: In 2017, Jasmin loaned her friend Janelle