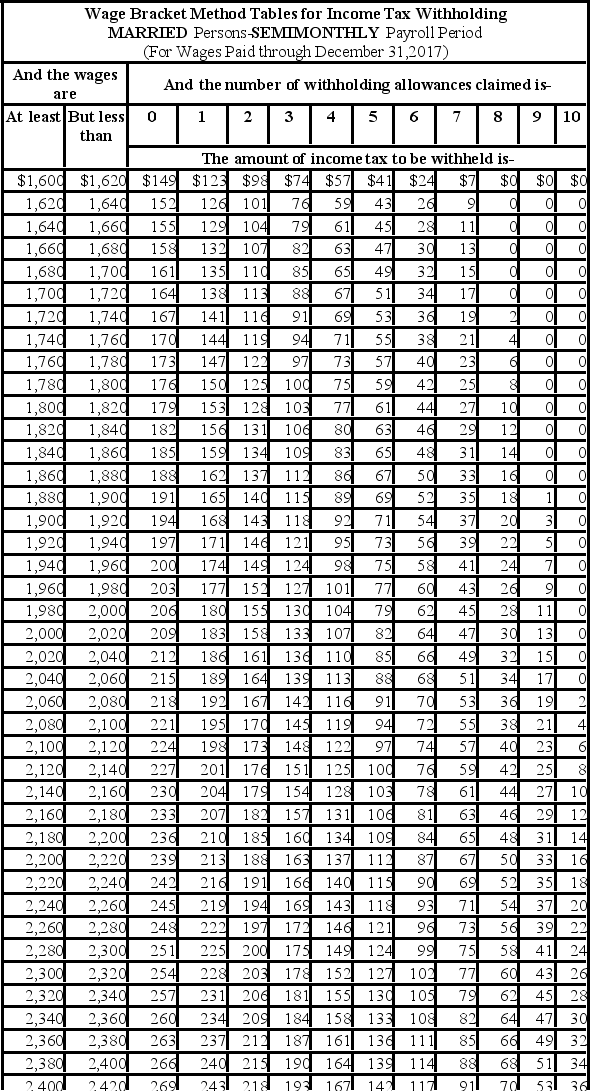

Trish earned $1,734.90 during the most recent semimonthly pay period. She is married and has 3 withholding allowances and has no pre-tax deductions. Based on the following table, how much should be withheld from her gross pay for Federal income tax?

Definitions:

Marginal Costs

The cost incurred by producing one additional unit of a product or service.

Total Variable Cost

The sum of all costs that vary with the level of output in the short run.

Average Fixed Costs

The fixed costs of production (expenses that do not change with the level of output) divided by the quantity of output produced.

Total Fixed Costs

The sum of all costs that do not change with the level of output produced by a business, such as rent, salaries, and insurance.

Q5: The discomfort and distress following discontinuing a

Q14: Plato's assumption that certain ideas are inborn

Q21: An employer must have an employee complete

Q21: In the event of an ethical breach

Q31: Considering the categories of marginally ethical negotiating

Q42: Under the influence of alcohol, angered people

Q49: Of the following, the best way to

Q49: Adam is a part-time employee who earned

Q62: Which copy of Form W-2 should be

Q106: The labels "easy," "difficult," and "slow-to-warm-up" are