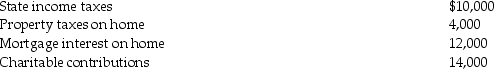

Tasneem,a single taxpayer has paid the following amounts in 2016:  Tasneem's AGI is $361,400.What is her net itemized deduction allowed?

Tasneem's AGI is $361,400.What is her net itemized deduction allowed?

Definitions:

Middle-Class

A social group that falls between the working class and the upper class, typically associated with moderate income levels, stable employment, and access to education.

US Physicians

Medical doctors licensed to practice medicine in the United States, encompassing various specialties and areas of medicine.

Chronic Pain

Persistent pain that lasts weeks to years, beyond the typical recovery period, often requiring complex management strategies.

Undertreat

The insufficient or inadequate treatment of a condition, often resulting in the persistence or worsening of symptoms and the condition's prognosis.

Q8: Carole owns 75% of Pet Foods,Inc.As CEO,Carole

Q18: Which one of the following substances is

Q26: John,an employee of a manufacturing company,suffered a

Q45: Jill is considering making a donation to

Q53: If property received as a gift has

Q71: During February and March,Jade spends approximately 90

Q87: Jan has been assigned to the Rome

Q88: Kendrick,who has a 33% marginal tax rate,had

Q92: Gross income may be realized when a

Q93: A taxpayer moves for employment in November