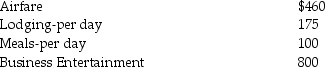

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:  What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

Definitions:

Periods Of Silence

Intervals of silence within a conversation or communication process, which can be culturally significant or reflective of the communicative context.

Office Time Gossiping

The act of engaging in informal conversation or rumors about others, typically not work-related, during office hours.

Hours

Units of time equivalent to 60 minutes, often used to measure the duration of work, services, or events.

Grapevine

An informal and unofficial channel of communication within an organization, often characterized by rumors and non-official information.

Q4: Desi Corporation incurs $5,000 in travel,market surveys,and

Q8: An example of an entitlement program is:<br>A)

Q14: A review of the 2015 tax file

Q20: An important function of water in exercise

Q21: Factors that affect the outcome of pregnancy

Q21: Martha,an accrual-method taxpayer,has an accounting practice.In 2014,she

Q22: Foods and beverages ingested immediately after an

Q38: A medication that can interfere with nutrient

Q44: Calcification of soft tissue may occur from

Q95: Ivan's AGI is about $50,000 this year,and