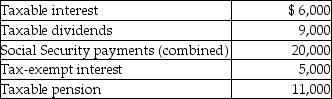

Mr.& Mrs.Bronson are both over 65 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

Definitions:

Multiple Variables

Multiple variables refer to the presence or use of more than one variable in an experiment or analysis to understand complex relationships or effects.

Random Assignment

A method used in experiments to allocate subjects randomly to experimental and control groups, ensuring each participant has an equal chance of any condition.

Technique

A systematic procedure, method, or skill applied in a particular task to achieve a desired result efficiently.

Testing Effect

An educational phenomenon where repeated testing on material leads to better memory retention than through study methods alone.

Q8: John,an employee of a manufacturing company,suffered a

Q33: The amount recaptured as ordinary income under

Q34: The sale of inventory results in ordinary

Q35: Funds borrowed and used to pay for

Q63: Coretta sold the following securities during 2015:

Q100: Deborah,who is single,is claimed as a dependent

Q115: If an individual with a marginal tax

Q116: Jonathon,age 50 and in good health,withdrew $6,000

Q117: If a capital asset held for one

Q124: John supports Kevin,his cousin,who lived with him