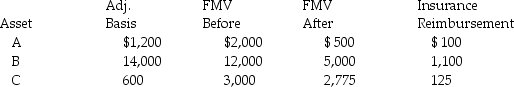

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2014 and the following occurred:

A and B were destroyed in the same casualty in March. C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March. C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Pierre-Joseph Proudhon

A French socialist philosopher and politician, best known for his declaration that "property is theft" in the context of his critique of the social injustices of his time.

External Benefits

Benefits of a product or service that are enjoyed by people who are not directly involved in the purchase or production of it.

Federal Government

The national government of a federal country, which holds the central political authority.

Abolition

The action of abolishing a system, practice, or institution, such as slavery or capital punishment.

Q3: During the 1930s Depression and World War

Q11: Generally, Section 267 requires that the deduction

Q16: According to the text book,a major reason

Q18: Research on trends in puberty often focuses

Q28: Mickey has a rare blood type and

Q42: Jocks,Brains,and Druggies are examples of _ that

Q46: Which of the following item(s)must be included

Q46: For charitable contribution purposes, capital gain property

Q70: All taxpayers are allowed to contribute funds

Q120: Ellie, a CPA, incurred the following deductible