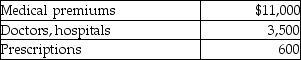

Caleb's medical expenses before reimbursement for the year include the following:  Caleb's AGI for the year is $50,000. He is single and age 58. Caleb also receives a reimbursement for medical expenses of $1,000. Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Caleb's AGI for the year is $50,000. He is single and age 58. Caleb also receives a reimbursement for medical expenses of $1,000. Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Definitions:

Q8: Canadian teens spend _ in sedentary activities

Q24: Assessments made against real estate for the

Q52: Donald has retired from his job as

Q64: An uncle gifts a parcel of land

Q69: Personal travel expenses are deductible as miscellaneous

Q73: Mr. and Mrs. Thibodeaux, who are filing

Q83: A net operating loss can be carried

Q118: Taxpayers may use the standard mileage rate

Q129: Steven is a representative for a textbook

Q130: Interest credited to a bank savings account