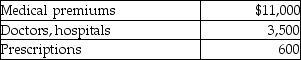

Caleb's medical expenses before reimbursement for the year include the following:  Caleb's AGI for the year is $50,000. He is single and age 58. Caleb also receives a reimbursement for medical expenses of $1,000. Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Caleb's AGI for the year is $50,000. He is single and age 58. Caleb also receives a reimbursement for medical expenses of $1,000. Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Definitions:

Murmur

A sound heard during heartbeat cycles, often indicative of a heart disorder but sometimes found in healthy hearts.

Lubb (S1)

The first heart sound in the cardiac cycle, associated with closure of the mitral and tricuspid valves at the beginning of ventricular contraction.

Dupp (S2)

A term referring to the duplication of the second heart sound, often associated with physiological or pathological cardiac conditions.

Pulmonary Trunk

The major blood vessel that carries deoxygenated blood from the right ventricle of the heart to the lungs for oxygenation.

Q6: Joe is a self-employed tax attorney who

Q13: In Howard Gardner's view,highly skilled dancers,athletes,and surgeons

Q21: In the early 20th century,Alfred Binet was

Q29: Brittany, who is an employee, drove her

Q37: Nelda suffered a serious stroke and was

Q53: Discuss the ways the proportion of adolescents

Q90: In the current year, ABC Corporation had

Q92: Raul and Jenna are married and are

Q106: All of the following are capital assets

Q116: Joycelyn gave a diamond necklace to her