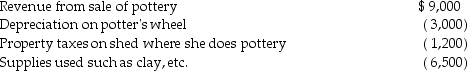

Lindsey Forbes, a detective who is single, operates a small pottery activity in her spare time. This year she reported the following income and expenses from this activity:

In addition, she had salary of $70,000 and itemized deductions, not including expenses listed above, of $6,800.

In addition, she had salary of $70,000 and itemized deductions, not including expenses listed above, of $6,800.

a. What is the amount of Lindsey's taxable income assuming the activity is classified as a hobby?

b. What is the amount of Lindsey's taxable income assuming the activity is classified as a trade or business?

Definitions:

Qualitative Research

Research that explores and understands phenomena in-depth by collecting non-numerical data, such as interviews, observations, and words.

Recycling

The process of converting waste materials into new materials and objects, aiming to reduce raw material use, energy consumption, and environmental impact.

Microworld

A simplified, manageable model of a complex system used for educational purposes or to simulate scenarios for research and analysis.

Computer-Based Simulation

Use of computer algorithms and models to replicate or mimic real-world processes, scenarios, or systems for analysis, prediction, or educational purposes.

Q15: Joy reports the following income and loss:

Q27: Amy's employer provides her with several fringe

Q34: Investment interest expense which is disallowed because

Q36: John is injured and receives $16,000 of

Q57: All of the following are deductible as

Q65: In a contributory defined contribution pension plan,

Q68: If a capital asset held for one

Q81: Richard traveled from New Orleans to New

Q90: Under the terms of a divorce agreement

Q102: Brad suffers from congestive heart failure and