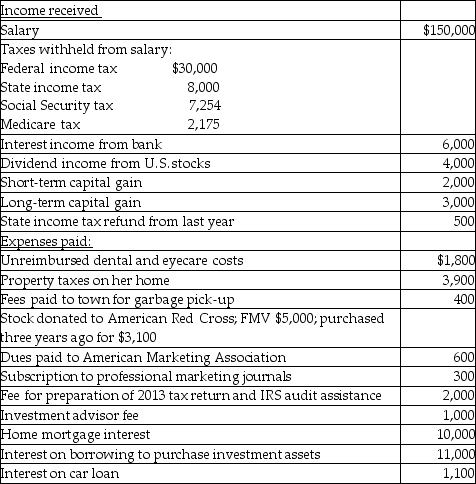

Hope is a marketing manager at a local company. Information about her 2014 income and expenses is as follows:

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Definitions:

Partial Billings

Invoicing for a portion of a project or contract's value before the work is fully completed, typically used in long-term contracts.

Net Assets

The difference between total assets and total liabilities, representing the owner's or shareholders' equity in a company.

Cost

The amount of money required to purchase something or the expense associated with creating a product or service.

Q19: During the current year, Nancy had the

Q20: A closely held C Corporation's passive losses

Q33: When are home-office expenses deductible?

Q42: What two conditions are necessary for moving

Q49: Legal fees for drafting a will are

Q56: Daniel had adjusted gross income of $60,000,

Q62: Corporate charitable deductions are limited to 10%

Q77: XYZ Corporation declares a 10 percent stock

Q107: Ron is a university professor who accepts

Q108: For a bad debt to be deductible,