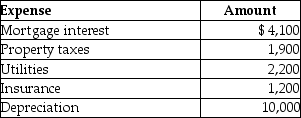

Abby owns a condominium in the Great Smokey Mountains. During the year, Abby uses the condo a total of 21 days. The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500. Abby incurs the following expenses:  Using the IRS method of allocating expenses, the amount of depreciation that Abby may take with respect to the rental property will be

Using the IRS method of allocating expenses, the amount of depreciation that Abby may take with respect to the rental property will be

Definitions:

Jay's Treaty

A 1795 treaty between the United States and Great Britain that sought to settle outstanding issues between the two countries following the American Revolution.

American Alliance

An organization or agreement among the United States and other nations for mutual benefit, particularly in defense or political cooperation.

France

A country in Western Europe known for its rich history, culture, and contributions to art, philosophy, and science.

Virginia and Kentucky Resolutions

In 1798 and 1799, the legislatures of Kentucky and Virginia crafted political declarations asserting that the federal Alien and Sedition Acts violated the Constitution.

Q17: Nate and Nikki have three dependent children

Q20: Jeannie, a single taxpayer, retired during the

Q20: Alan, who is a security officer, is

Q22: In a community property state, jointly owned

Q30: If a nontaxable stock dividend is received

Q46: Generally, expenses incurred in an investment activity

Q51: Kendrick, who has a 35% marginal tax

Q72: Claudia refinances her home mortgage on June

Q97: The fair value of lodging cannot be

Q120: Ben, age 67, and Karla, age 58,