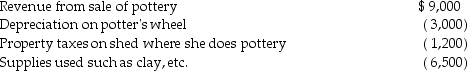

Lindsey Forbes, a detective who is single, operates a small pottery activity in her spare time. This year she reported the following income and expenses from this activity:

In addition, she had salary of $70,000 and itemized deductions, not including expenses listed above, of $6,800.

In addition, she had salary of $70,000 and itemized deductions, not including expenses listed above, of $6,800.

a. What is the amount of Lindsey's taxable income assuming the activity is classified as a hobby?

b. What is the amount of Lindsey's taxable income assuming the activity is classified as a trade or business?

Definitions:

Sexually Satisfied Couples

Partners in a romantic relationship who express fulfillment and contentment with their sexual experiences together.

Sexual Episode

An event encompassing sexual activity, which may involve physical pleasure, intimacy, and emotional expression.

Desire, Arousal

Components of sexual response that include the psychological longing for sexual activity and the physiological preparation of the body for sexual engagement.

Male Hypoactive Sexual Desire Disorder

A condition characterized by persistently low or absent sexual desire or fantasies in men, which cannot be explained by other medical conditions or drugs.

Q4: Normally, a security dealer reports ordinary income

Q27: Amy's employer provides her with several fringe

Q34: Adam purchased stock in 2006 for $100,000.

Q54: Matt is a sales representative for a

Q55: Tom and Alice were married on December

Q66: Property settlements made incident to a divorce

Q73: Mr. and Mrs. Thibodeaux, who are filing

Q89: Section 1221 of the Code includes a

Q91: Taxpayers who own mutual funds recognize their

Q116: Joycelyn gave a diamond necklace to her