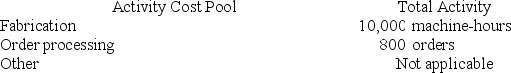

Tatman Corporation uses an activity-based costing system with the following three activity cost pools:  The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs.

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs.

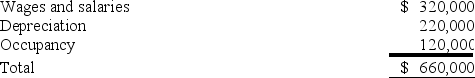

The company has provided the following data concerning its costs: The distribution of resource consumption across activity cost pools is given below:

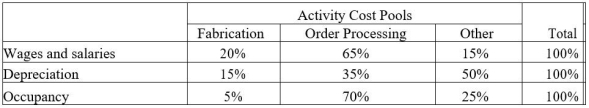

The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Fabrication activity cost pool is closest to:

The activity rate for the Fabrication activity cost pool is closest to:

Definitions:

Base Class

The class from which properties and methods are inherited to create derived classes.

Parent Class

A class that is being inherited from by another class. The derived class can access its public and protected fields and methods.

Derived Class

A class in object-oriented programming that inherits attributes and behaviors from another class, known as the base class.

Derived Class

A class in object-oriented programming that inherits properties and methods from a base or parent class, also known as a subclass.

Q62: A company has provided the following data

Q71: Wedd Corporation uses activity-based costing to assign

Q89: Tsosie Corporation makes one product and it

Q90: Cannula Vending Corporation is expanding operations and

Q125: Flemming Corporation uses activity-based costing to compute

Q143: Ahrends Corporation makes 70,000 units per year

Q158: Plummer Corporation has provided the following data

Q178: (Ignore income taxes in this problem.) Mattice

Q189: Goertz Corporation has an activity-based costing system

Q199: Hails Corporation manufactures two products: Product Q21F