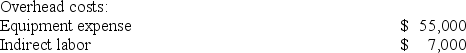

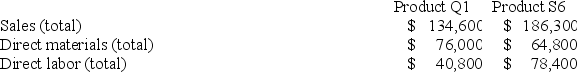

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

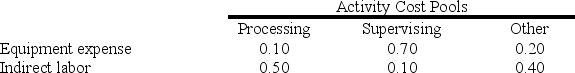

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

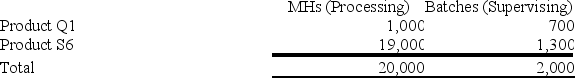

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Sales and Direct Cost Data: What is the overhead cost assigned to Product Q1 under activity-based costing?

What is the overhead cost assigned to Product Q1 under activity-based costing?

Definitions:

Opportunity Cost

The importance of the best alternative sacrifice due to choosing a particular path.

Bushel

A unit of volume that is used for measuring agricultural products such as grains, with the exact size varying by commodity and country.

Oranges

A citrus fruit commonly consumed fresh or processed for its juice, known for its rich vitamin C content.

Terms of Trade

The ratio at which a country can trade its exports for imports from other countries, reflecting the relative prices of goods between nations.

Q4: Desilets Corporation has provided the following data

Q4: Decorte Corporation uses a job-order costing system

Q13: Costs that can be eliminated in whole

Q36: Cranston Corporation makes four products in a

Q133: Scheuer Corporation uses activity-based costing to compute

Q152: Vandezande Inc. is considering the acquisition of

Q153: Treads Corporation is considering the purchase of

Q195: The following data pertain to last year's

Q206: Carriveau Corporation has two divisions: Consumer Division

Q265: Fatzinger Corporation has two production departments, Milling