Doles Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.

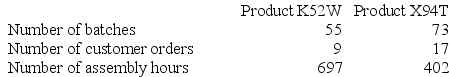

Data concerning two products appear below:

Data concerning two products appear below:

Required:

Required:

How much overhead cost would be assigned to each of the two products using the company's activity-based costing system?

Definitions:

Fair Value

The amount one would expect to get from selling an asset or the cost to transfer a liability during a regulated transaction involving parties in the market.

Directly Attributable Costs

Costs that can be directly associated with a specific asset or service, and which would not have been incurred if the asset or service had not been acquired or produced.

Financial Liability

An obligation to deliver cash or another financial asset to another entity.

Legally Enforceable Right

A right that is recognized by law and can be upheld in a court.

Q35: Daston Company manufactures two products, Product F

Q70: (Ignore income taxes in this problem.) Choudhury

Q80: Janos Corporation, which has only one product,

Q80: Figge & Mathews PLC, a consulting firm,

Q85: Purves Corporation is using a predetermined overhead

Q153: Wyrich Corporation has two divisions: Blue Division

Q172: Ahrends Corporation makes 70,000 units per year

Q200: WP Corporation produces products X, Y, and

Q221: Ross Corporation produces a single product. The

Q249: Fowler Corporation manufactures a single product. Operating