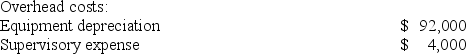

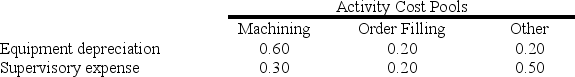

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.

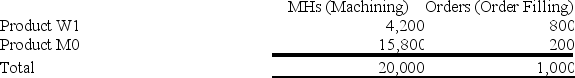

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.

Activity: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

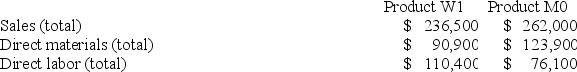

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Sales and Direct Cost Data: How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Variable Overhead Efficiency Variance

A measure used in cost accounting to evaluate the efficiency of variable production costs, comparing the actual hours worked to the standard hours expected.

Materials Price Variance

The difference between the actual cost of materials and the expected (standard) cost.

Labor Rate Variance

A measure used in cost accounting to analyze the difference between the actual labor cost incurred and the standard labor cost for the actual labor hours worked.

Variable Overhead Efficiency Variance

Refers to the difference between the standard cost of variable overheads for the actual production level and the actual variable overheads incurred.

Q10: Groleau Corporation has an activity-based costing system

Q11: Muckleroy Corporation has two divisions: Division K

Q21: Which of the following costs are always

Q44: Melbourne Corporation has traditionally made a subcomponent

Q70: (Ignore income taxes in this problem.) Choudhury

Q72: Stoneberger Corporation produces a single product and

Q100: Two alternatives, code-named X and Y, are

Q174: Steele Corporation uses a predetermined overhead rate

Q212: Bachrodt Corporation uses activity-based costing to compute

Q253: Allocating common fixed costs to segments on