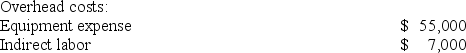

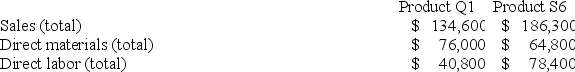

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

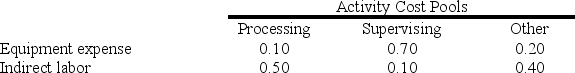

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

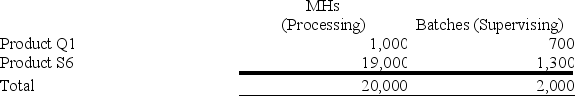

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Sales and Direct Cost Data: What is the product margin for Product Q1 under activity-based costing?

What is the product margin for Product Q1 under activity-based costing?

Definitions:

Group Project

A collaborative assignment or task undertaken by a group of people, typically students, aiming to achieve a common objective.

Resilient

The ability to quickly recover from difficulties; emotional strength and toughness.

Business Trip

A journey undertaken for work or professional reasons, often involving travel outside one's regular place of employment.

Long-Term Goal

An objective or aim that is intended to be achieved over a prolonged period, often several years or more.

Q11: An automated turning machine is the current

Q19: Danahy Corporation manufactures a single product. The

Q42: The minimum required rate of return is

Q78: Marley Corporation makes three products (X, Y,

Q84: Millner Corporation has provided the following data

Q86: Ferrar Corporation has two major business segments:

Q173: When a company implements activity-based costing, manufacturing

Q207: Coates Corporation uses a job-order costing system

Q214: A company that produces a single product

Q290: Nelter Corporation, which has only one product,