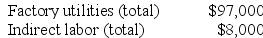

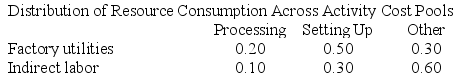

Hagy Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Data concerning the company's costs and activity-based costing system appear below:

Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Petroleum

A liquid mixture of hydrocarbons present in certain rock strata, used primarily as a fuel source.

Oil and Gas

Natural resources found beneath the Earth's surface, used as crucial energy sources and raw materials in various industries.

Rising Salt Dome

A geological formation where a column of salt moves upward through overlying sediments, often forming a dome-like structure.

Fault Zone

A fault zone is a region of the Earth's crust characterized by one or more faults, which are fractures along which there has been displacement of the sides relative to one another.

Q9: Lupo Corporation uses a job-order costing system

Q15: Beans Corporation uses a job-order costing system

Q47: Highpoint, Inc., is considering investing in automated

Q145: (Ignore income taxes in this problem.) Cardinal

Q158: Neas Corporation has an activity-based costing system

Q168: Morataya Corporation has two manufacturing departments--Machining and

Q190: Landor Appliance Corporation makes and sells electric

Q191: Opunui Corporation has two manufacturing departments--Molding and

Q200: Dobles Corporation has provided the following data

Q211: Harootunian Corporation uses a job-order costing system