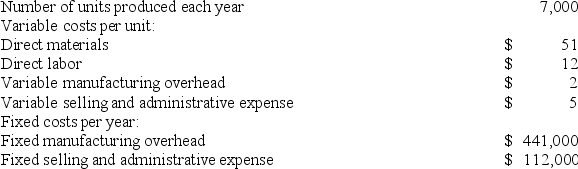

Mullee Corporation produces a single product and has the following cost structure:  The absorption costing unit product cost is:

The absorption costing unit product cost is:

Definitions:

Direct Labor Hours

The total hours of labor directly involved in producing goods or providing services, used in calculating labor costs and efficiency.

Period Costs

Expenses on the income statement not directly tied to the production of goods, such as administrative and selling expenses.

Conversion Costs

The sum of labor costs and overhead expenses associated with transforming raw materials into finished goods.

Factory Overhead Costs

All the indirect costs associated with manufacturing, excluding direct materials and direct labor costs; includes costs such as maintenance, utilities, and rent.

Q24: Dehner Corporation uses a job-order costing system

Q46: Addleman Corporation has an activity-based costing system

Q101: Dehner Corporation uses a job-order costing system

Q178: The Melville Corporation produces a single product

Q183: When computing the break even for a

Q201: Carroll Corporation has two products, Q and

Q223: Most countries require some form of absorption

Q240: Nuzum Corporation has two divisions: Division M

Q254: Deloria Corporation has two production departments, Forming

Q283: Under variable costing, all variable production costs