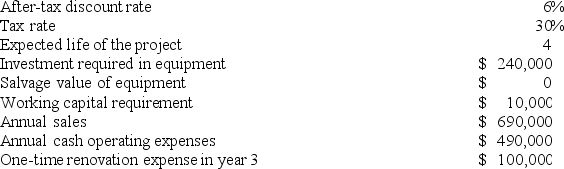

Lafromboise Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

Definitions:

Quadratus Lumborum

A deep muscle in the lower back that helps with the stabilization of the pelvis and the spine, as well as aiding in lateral movement of the torso.

Serratus Posterior

A muscle group consisting of the serratus posterior superior and inferior, which aid in the movements of the rib cage.

Splenius Capitis

A muscle in the back of the neck that plays a crucial role in controlling the movement of the head, particularly in extension and rotation.

Vertebral Column

The vertebral column, also known as the spine or backbone, is a series of interconnected bones called vertebrae that enclose and protect the spinal cord while allowing a person to stand upright and move flexibly.

Q7: Marder Woodworking Corporation produces fine cabinets. The

Q8: Cabigas Corporation manufactures two products, Product

Q45: Waltermire Corporation has provided the following information

Q77: Lamorte Corporation is conducting a time-driven activity-based

Q83: Pascal Corporation manufactures numerous products, one of

Q86: Code Corporation is conducting a time-driven activity-based

Q120: Chruch Corporation manufactures numerous products, one of

Q166: Zotta Enterprises uses standard costing and applies

Q177: The budget variance for fixed manufacturing overhead

Q197: Mark is an engineer who has designed