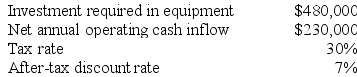

Rapozo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Condensation Point

The temperature at which a gas becomes a liquid; the cooling point where gaseous substances convert into their liquid state.

Alkanes

Hydrocarbons containing only single bonds between carbon atoms, with the general formula CnH2n+2.

Solvents

Substances that dissolve a solute, resulting in a solution; typically liquids but can also be solid or gas.

Non-Reactive

A term describing substances that do not easily undergo chemical reactions or bond with other substances.

Q6: Buzby Corporation manufactures numerous products, one of

Q29: Chruch Corporation manufactures numerous products, one of

Q41: The least-squares regression method computes the regression

Q69: Conaghan Avionics Corporation has developed a new

Q72: Keeran Corporation estimates that its variable manufacturing

Q78: Turnhilm, Inc. is considering adding a small

Q81: Magney, Inc., uses the absorption costing approach

Q83: Grassie Corporation is conducting a time-driven activity-based

Q86: Debona Corporation is considering a capital budgeting

Q95: All cash inflows are taxable.