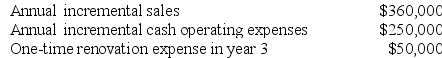

Yau Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with a 4 year useful life and zero salvage value. Data concerning that project appear below:

An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 9%.

An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 9%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Coefficient Of Determination

A statistical measure, often denoted as R^2, that represents the proportion of the variance for a dependent variable that's predictable from the independent variables in a model.

Adjusted Coefficient

Refers to statistical measures that have been modified to account for certain factors or variables, enhancing the comparability or accuracy of the results.

Independent Variables

Variables in an experiment that are manipulated or categorized to determine their effect on dependent variables.

Sample Size

The count of samples or entities selected from a bigger group intended for statistical examination.

Q6: The management of Casablanca Manufacturing Corporation believes

Q16: Most of the opportunities to reduce the

Q23: A company anticipates incremental net income (i.e.,

Q26: Ledonne Corporation is conducting a time-driven activity-based

Q35: Schweinsberg Corporation is considering a capital budgeting

Q55: Dobosh Corporation has provided the following information:<br>

Q71: Tullio Corporation is conducting a time-driven activity-based

Q101: In a Capacity Analysis report in time-based

Q117: Ecob Corporation uses the absorption costing approach

Q137: Demand for a product is said to