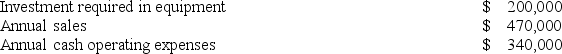

Chene Corporation has provided the following information concerning a capital budgeting project:  The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

Definitions:

Amortized Cost

Amortized cost is an investment's acquisition cost adjusted for amortization, impairment charges, and any accumulated payment or receipts since acquisition.

Market Value

The market's current rate for buying or selling an asset or service.

Available-for-Sale Investments

These are securities that are not classified as held-to-maturity or trading securities, and can be sold in the future.

Common Stock

Equity ownership in a corporation, providing voting rights and a share in the company’s profits through dividends.

Q8: The management of Plitt Corporation would like

Q14: Elerson Corporation is conducting a time-driven activity-based

Q22: Nessen Corporation has provided the following information

Q23: Campanaro Corporation is conducting a time-driven activity-based

Q29: Layer Corporation has provided the following information

Q120: Last year the sales at Summit Corporation

Q125: Twisdale Corporation manufactures numerous products, one of

Q145: Harris Corporation uses a standard cost system

Q234: Dizzy Amusement Park is open from 8:00

Q261: Bauman Sales Corporation, a merchandising company, reported