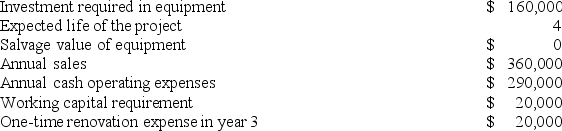

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 3 is:

Definitions:

Direct Labour Price Variance

The difference between the actual cost of direct labor and the expected (or standard) cost, based on the actual hours worked.

Direct Labour Standards

Pre-determined measures of how much labor (time or cost) should be used to produce a unit of product or perform a service.

Total Cost

The complete cost of producing or acquiring goods or services, including both fixed and variable components.

Direct Material Quantity Variance

The difference between the expected and actual quantity of materials used in production, affecting the total manufacturing cost.

Q2: Rohn Corporation is conducting a time-driven activity-based

Q18: Maccarone Corporation manufactures numerous products, one of

Q32: When the predetermined overhead rate is based

Q89: Carattini Incorporated makes a single product-an electrical

Q97: Callum Corporation is conducting a time-driven activity-based

Q97: A company needs an increase in working

Q101: Mester Corporation has provided the following information

Q114: In a Cost Analysis report in time-based

Q127: Zotta Enterprises uses standard costing and applies

Q176: Pickell Incorporated makes a single product--a cooling