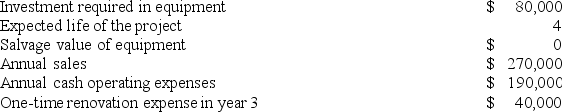

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Probable

In financial and legal contexts, a high likelihood that an event will occur, often used in reference to the realization of assets or the incurrence of liabilities.

Reasonably Estimated

A valuation or measurement that can be calculated with a reasonable level of accuracy, often applied in accounting for provisions and contingencies.

Fair Value Option

The choice given to companies to report financial assets and liabilities at estimates of their current market value, rather than at historical cost or using other valuation methods.

Accounting-induced Volatility

Accounting-induced volatility is the fluctuation in financial metrics or stock prices resulting from changes in accounting principles or practices.

Q2: You have deposited $7,620 in a special

Q19: The following information concerning a proposed capital

Q44: Schubert Corporation manufactures and sells one product.

Q63: Annala Corporation is considering a capital budgeting

Q93: Lamorte Corporation is conducting a time-driven activity-based

Q110: Gauch Corporation is conducting a time-driven activity-based

Q112: Nance Corporation is about to introduce a

Q123: Planas Corporation has provided the following information

Q132: A partial listing of costs incurred at

Q286: Lagle Corporation has provided the following information: