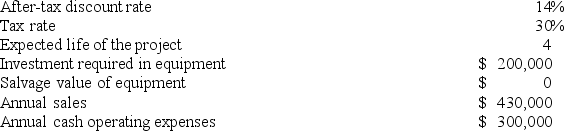

Rollans Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Standard Variable Overhead

The budgeted, or standard, cost associated with variable overheads that change with the level of production activity.

Actual Units Produced

refers to the tangible count of items manufactured during a specific period in a production facility.

Variances

The difference between planned, budgeted, or standard costs and actual costs, often analyzed to understand and improve business performance.

Standard

A level of quality or attainment.

Q2: Rohn Corporation is conducting a time-driven activity-based

Q49: Padmore Corporation has provided the following information

Q64: Imbesi Corporation is conducting a time-driven activity-based

Q81: Stokan Products, Inc., has a Antennae Division

Q86: Debona Corporation is considering a capital budgeting

Q87: Stopyra Incorporated makes a single product-a cooling

Q97: The Northern Division of Fiscar Corporation sells

Q135: Twisdale Corporation manufactures numerous products, one of

Q170: The economic impact of the inability to

Q261: Bauman Sales Corporation, a merchandising company, reported