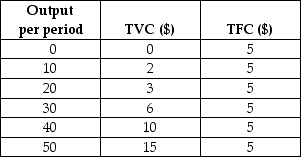

Consider the following total cost schedule for a perfectly competitive firm producing ball-point pens.

TABLE 9-3

TABLE 9-3

-Refer to Table 9-3.If this firm were producing at an output level of 30 units,the AFC would be ________ and the AVC would be ________.

Definitions:

Expected Return

The mean value of the probability distribution of possible returns from an investment or portfolio.

Expected Return-Beta Relationship

A concept in finance that describes the relationship between the risk of an investment and its expected return, based on the beta coefficient.

APT

The Arbitrage Pricing Theory, a model that determines the required return on an asset by considering various macroeconomic factors.

CAPM

The Capital Asset Pricing Model, a financial theory that describes the relationship between systematic risk and expected return for assets, particularly stocks.

Q8: If a monopolistʹs marginal revenue is MR

Q16: Both empirical evidence and everyday observation suggest

Q22: For your typical consumption levels of water

Q31: An imperfectly competitive industry is often allocatively

Q51: Refer to Figure 11-1.If this firm is

Q53: Refer to Figure 13-1.This firmʹs MRP curve

Q75: Of the following,which is the least likely

Q79: Marginal utility analysis predicts a downward-sloping demand

Q84: In Canada,concentration ratios are the highest in<br>A)tobacco

Q118: When economists say that a perfectly competitive