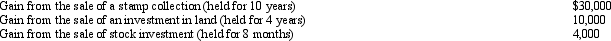

Perry is in the 33% tax bracket.During 2013,he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

Definitions:

Shareholder's Equity

The residual interest in the assets of a corporation after deducting liabilities, often represented by stock capital and retained earnings.

Internally Generated Trademark

A trademark that has been developed through the internal efforts of a company, not acquired or purchased from a third party.

Contingent Liability

(a) A possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity; or (b) a present obligation that arises from past events but is not recognised because: (i) it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation; or (ii) the amount of the obligation cannot be measured with sufficient reliability.

Business Combination Valuation

The process of estimating the value of different companies coming together through acquisitions or mergers.

Q10: John files a return as a single

Q17: Which of these is not a correct

Q25: In the year of her death,Maria made

Q43: A worker may prefer to be classified

Q57: Brooke works part-time as a waitress in

Q97: Maud exchanges a rental house at the

Q114: A taxpayer who uses the automatic mileage

Q130: The stock of Eagle,Inc.is owned as follows:<br>

Q150: Lynn purchases a house for $52,000.She converts

Q165: The work-related expenses of an independent contractor